The Round table was attended by a representative of the Ministry of labor and social welfare, a representative of the Ministry of Finance, a representative of the Union of Employers if Montenegro, Secretary General, experts, representatives of the CTUM branch trade unions, as well as a representative of the Union of Free Trade Unions of Montenegro – the organization that recently became an affiliate of ITUC and ETUC, and numerous media representatives.

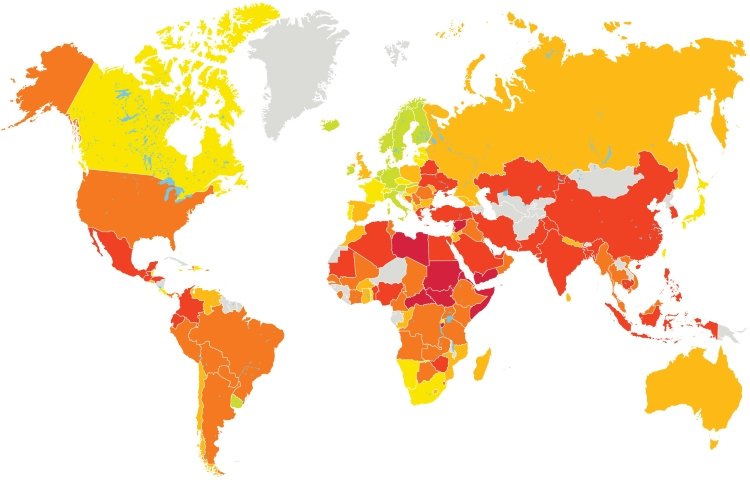

The participants have discussed national report on the situation in Montenegro in relation to taxation policy, informal economy, and corruption. Mr. Martin Hutsebaut, EU expert, presented the Comparative analysis of the situation in Montenegro, compared to the countries in the region and EU member states.

CTUM experts have presented the Project results, basic parts of the document on taxation policy and the link with informal economy and corruption. Participants conducted a very active discussions, and concluded that it is important to continue working on the reforms of taxation policies so as to make it fairer and influence reduction of grey economy, which would ultimately prevent enormous financial means from entering grey money flows.

Position of Montenegrin trade unions on taxation policy: From a social position, direct taxes should have primacy over the indirect taxes. Taxation of capital profit should be better harmonized with the taxation of labor income. To increase the efficiency of taxation system, a matter of tax evasion and tax fraud should be resolved. Considering the effect of economic crisis, we are all in, the crucial things for its overcoming are based on both fiscal and financial discipline. Different measures may contribute to the improvement of tax collection and higher level of discipline. Introduction of progressive taxation system would be beneficial for the fiscal policy of Montenegro.

There are different assessments related to the rates of grey economy in Montenegro. Based on the study of the Institute for strategic studies and prognoses (ISSP), unregistered work mainly occurs in sectors of retail (38,1%), agriculture (18,2%), catering services (19,1%), civil construction (10,8%) and transport (9,6%) (ISSP, 2010). The most important reasons for shifting a part of economic activities of economic subjects towards the so-called “grey area” are inadequate or poorly implemented economic and social policies, lack of appropriate legislative and institutional frameworks, poor application of laws, reduced trust to the institutions and administrative procedures, and weak economic growth followed by reduced liquidity and productivity of economic subjects. Reduction of informal economy is one of the imperatives for the Government of Montenegro. In conditions of extended crisis, still slow economic growth, the intensive fight against grey economy along with the enforcement of a series of urgent measures aimed of fiscal adjustments aimed at the improvement of both expenditure and revenue sides of budget would result in the increased collection of public revenues.

Media have also shown a big interest for this event and the subject of this Round table.

ITUC / PERC Office for SEE – Sarajevo